Home ›› 07 Aug 2021 ›› Stock

After a year marred with restrictions inflicted by the Covid-19 pandemic, Linde Bangladesh, a multinational oxygen supplier, has successfully bounced back in production and witnessed significant increase in revenue and profit in the first half of the current year.

Although the listed company did not report any loss last year, it was apparently in crisis as the production activities were severely disrupted by the pandemic-induced restrictions and some other setbacks.

Recently, the coronavirus infections peaked in Bangladesh, so did the demand for oxygen.

Linde Bangladesh is now focused on gearing up its production and meeting the increased demand of medical oxygen, in an effort to retain the upward trend in profit and revenue.

The company will build a debulking Station near Benapole port within the current year. It would act as a buffer for oxygen and other gases and improve reliability and distribution support.

The company also took an initiative to revamp the Shitalpur plant in Chattogram to gear up production.

Besides, the company will set up a new plant in the next three to four years and keep a close eye on competitors to retain own business.

In addition to local production, the MNC will ensure uninterrupted oxygen import, bring about necessary reforms in its policy, and facilitate more investments in the newly undertaken projects.

This scenario was obtained analysing the company’s last year’s annual report and the financial report for the second quarter of this year.

The main product of Linde BD is medical oxygen. During the pre-pandemic period, the daily demand of medical oxygen was 30-35 tonnes in Bangladesh.

However, the demand scaled up to 70-75 tonnes per day amid the pandemic.

At the end of last year, Linde Bangladesh encountered some major setbacks in oxygen production in its both two plants and was forced to suspend oxygen supply to industries.

But it managed to continue the supply of medical oxygen.

As a result, the company’s revenue declined last year, so did its profits.

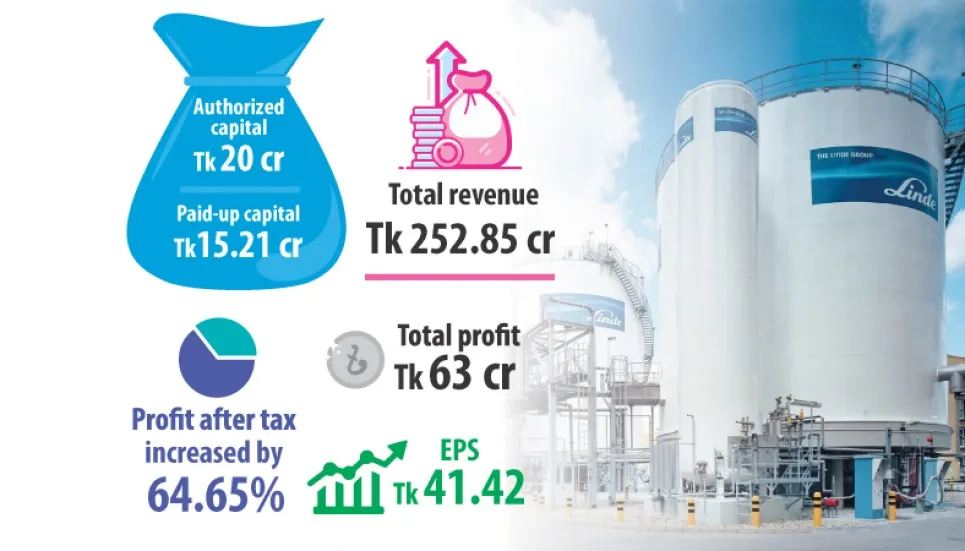

However, Linde Bangladesh turned around in the first six months of this year as its revenue increased by around 26 per cent and stood at Tk 252.85 crore, which was Tk 200.79 crore in the corresponding period of last year.

Its profit after tax also increased by 64.65 per cent during the period and stood at Tk 63 crore, which was Tk 38.28 crore in the same period of last year.

At the same time, the company’s earnings per share (EPS) increased to Tk 41.42 from Tk 25.18.

The last year’s picture was in stark contrast to that of the first half of current year.

The company’s sales fell by 17.1 per cent in 2020, while revenue and profit decreased by 12.8 per cent. It reported profit of Tk 107.35 crore for 2020, which was Tk 123.14 crore in 2019.

However, it did not face any loss thanks to timely import of oxygen, reduction in raw material and electricity costs and increase in sales of hard goods.

The MNC disbursed lower dividend – 400 per cent – to its shareholders for the year ended on December 31, 2020. In the previous year, it provided the highest ever dividend — 500 per cent — to the shareholders.

Ayub Quadri, chairman of Linde Bangladesh, said in the annual report of 2020 that the profit fall did not imply business fall. He described the previous year’s business success as quite good considering the challenges.

“Only a numerical comparison with the past years cannot reflect the real picture,” he added.

The Linde Group has a history of over 130 years built on a heritage of innovation with a strong focus on technology.

Linde Bangladesh Limited, a member of the Linde Group, was listed on the Dhaka Stock Exchange and Chittagong Stock Exchange in 1976.

The company’s authorised capital is Tk 20 crore while its paid-up capital is Tk 15.21 crore, according to DSE data.