Home ›› 25 Aug 2021 ›› Stock

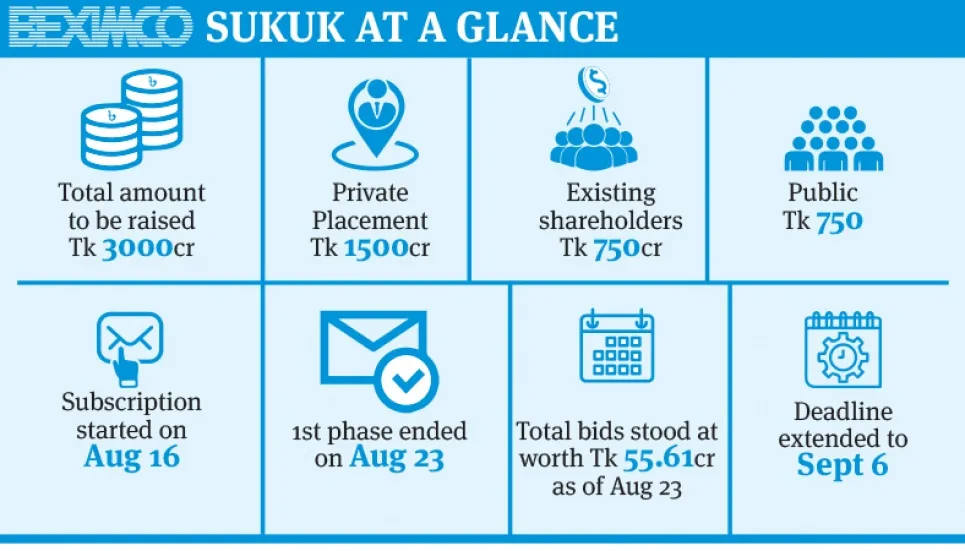

In the face of low response from the qualified investors, the subscription timeframe for the Shariah-compliant green Sukuk bond of Bangladesh Export Import Company Limited has been extended for another two weeks.

Thanks to the development, the investors can now subscribe for the private sector’s largest Sukuk bond until September 6, according to a disclosure made to the Dhaka Stock Exchange on Tuesday.

The subscription process started on August 16 and was expected to close on August 23.

The company set a target to raise Tk 750 crore from the public through the initial public offering (IPO) shares.

However, only 7.42 per cent of the target was achieved as it received bids worth Tk 55.61 crore from some 71 institutional investors during the stipulated period.

The Sukuk units, with a face value of Tk 100 each, will be offered in a lot of 50 units or multiples that would amount to at least Tk 5,000. However, there is no limit to the subscription process.

Earlier on July 25, existing shareholders of Beximco Limited started to convert to the Green Sukuk bonds. The process will continue till August 26.

The Bangladesh Securities and Exchange Commission (BSEC) approved the issuance of a Tk 3,000 crore green Sukuk bond in favor of Beximco Limited on June 23, to finance construction goals and equipment procurement.

Sukuk is an Islamic financial certificate, similar to a treasury bond, which complies with Shariah laws.

The tenure of the bond is five years, of which investors will gain a minimum of 9 per cent as secured annual return.

As per the commission’s statement, half of the Tk 3,000-crore fund would be raised through private placement, and Sukuk worth Tk 750 crore would be raised from the existing Beximco shareholders.

The remaining Tk 750 crore will be raised through an initial public offering in compliance with the commission’s public offer rules.

Sukuk holders will have the option to convert up to 20 per cent of the Sukuk to ordinary shares of Beximco Ltd annually at a 25 per cent discount to the conversion price. The conversion price will be the weighted average price of 20 trading days before the record date.

As per company sources, the fund raised from the Sukuk will be used for the construction of two solar projects – Teesta Solar and Korotoa Solar – the two subsidiaries of Beximco Power Company, and financing and refinancing machinery and equipment required for expansion of Beximco’s textile division.

The Investment Corporation of Bangladesh (ICB) is the trustee of the bond offering. The City Bank Capital Resources Limited and Agrani Equity & Investment Limited are the issue managers of the bond.