Home ›› 03 Sep 2021 ›› Stock

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), witnessed steep rise on Thursday as optimistic investors continued their buying spree amid growing confidence in the market.

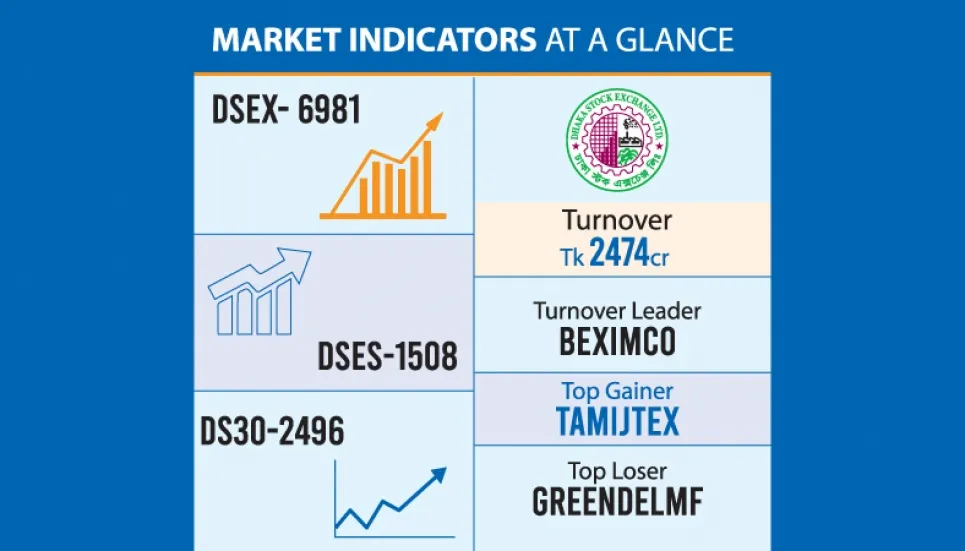

On the last trading session of the week, the index gained 64.7 points or 0.94 per cent to settle at the new high of 6,981 points at the country’s prime bourse.

The turnover, another key market indicator, increased by 4.56 per cent to Tk 2,474 crore at the bourse, with the general insurance sector dominating the turnover chart. The sector covered 14.38 per cent of the total turnover.

Apart from that, the market capitalization of the Dhaka bourse stood at the historically highest level of Tk 5,63,715 crore.

At the day’s end, DSES and DS30 added 13 points and 22 points respectively to their previous day’s level.

Of the 373 issues traded, 237 advanced, 105 declined, and 31 remained unchanged on Dhaka bourse on the day.

International Leasing Securities, in its daily market commentary, said that the Dhaka stocks sustained its upward rally for the last three consecutive sessions as the optimistic investors continued their buying spree amid growing confidence in the market.

The investors persisted their buoyancy in the stocks due to lower return in the money market along with the regulatory moves.

The central bank asked all the scheduled banks to submit information regarding investment from their special fund on a monthly basis. Besides, the securities regulator approved the revised public issue rules extending the general investors quota in the initial public offering may have encouraged people to invest in stocks.

Optimistic investors showed their buying interest in almost all the major sectors that helped the benchmark index to add 157 points in the last three sessions.

The market turnover increased by 5 per cent in the last sessions as both the high net worth individual and institutional investors were active on the trading floor.

EBL Securities, in its daily market commentary, said that the bullish trend from the beginning of the session persisted till the closure as investors engaged in buying bonanza with anticipation that the market may cross the threshold of 7,000-points soon.

Moreover, the latest regulatory measure to increase the IPO quota for general investors has impacted the investor’s sentiment positively.

On the sectoral front, general insurance (14.38 per cent), engineering (12.74 per cent), and pharma (9.45 per cent) issues were the most traded stocks on the day’s trading board.

Most of the sectors exerted positive returns, out of which jute (3.4 per cent), ceramic (3.0 per cent), and miscellaneous (2.0 per cent) have exerted the most returns while life insurance (-0.1 per cent) and food & allied (-0.1 per cent) observed corrections on the bourse.

On Thursday, Beximco topped the turnover list, followed by Bangladesh National Insurance, Beximco Pharma, GPH Ispat, and LafargeHolcim. Low-cap companies continued to dominate the gainers’ list, while Samata Leather Complex aced the day’s top gainer list.

Green Delta Mutual Fund was the worst loser of the day, by losing 9.37 per cent share price.

Meanwhile, port city bourse Chittagong Stock Exchange (CSE) also ended in green terrain. The selected indices (CSCX) and All Share Price Index (CASPI) advanced by 102.3 points and 171.4 points respectively

The turnover value of Tk 88 crore in the CSE. Out of the 323 issues traded, 183 advanced, 105 declined, and 35 remained unchanged on the bourses.