Home ›› 02 Jan 2022 ›› Stock

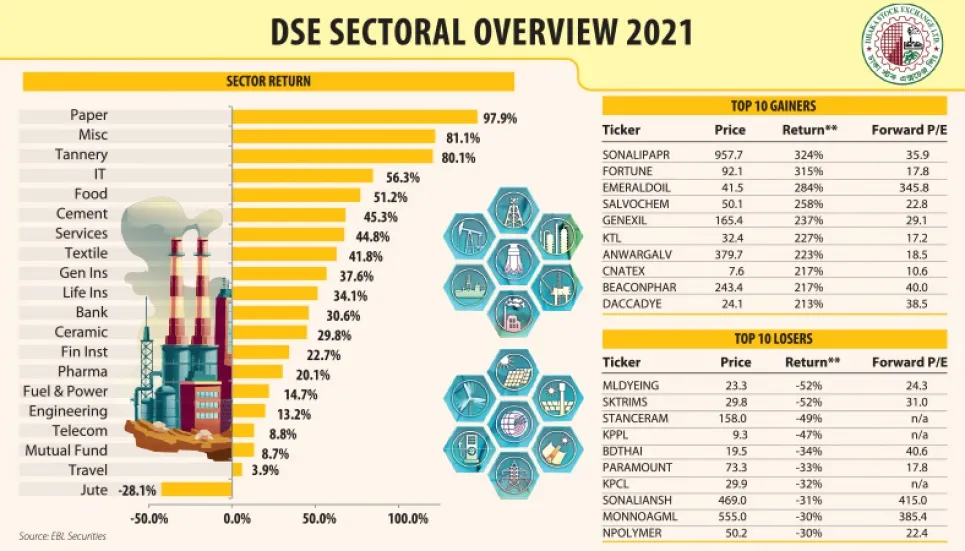

The low-cap paper and printing sector emerged as the best performer of the Dhaka Stock Exchange (DSE) in 2021 with a gain of 98 per cent, while the jute sector was the worst performer with a loss of 28 per cent.

The sector, which comprises six companies, generated the highest return, led by Sonali Paper and Board Mills, which posted a 324 per cent rise in the just-concluded year.

Meanwhile, ML Dyeing was the worst loser of the year with a fall of 52 per cent.

The miscellaneous sector came in second with an 81 percent return on investment for the year, as the prices of most companies in this sector skyrocketed.

The sector, which comprises 14 companies, generated the highest return, led by Bangladesh Export Import Company (Beximco).

The tannery sector came next, with a 101 per cent return in 2021. Other sectoral returns include IT (56 per cent), food (51 per cent), cement (45 per cent), service (45 per cent), textile (41 per cent), general insurance (37 per cent), life insurance (34 per cent), bank (30 per cent), ceramic (298.8 per cent), NBFI (22 per cent), pharma (20 per cent), power (14 per cent), engineering (13 per cent), telecom (8.8 per cent), mutual fund (8.7 per cent), and travel (3.9 per cent).

When the overall performances of all the listed companies are taken into account, the investors get the highest 324 per cent return from the Sonali Paper, followed by Fortune Shoes’ 315 per cent, Emerald Oil’s 284 per cent, Salvo Chemical’s 258 per cent, Genex Infosys’ 237 per cent, Kattali Textile’s 227 per cent, Anwar Galvanizing’s 223 per cent, C&A Tetile’s 217 per cent, Beacon Pharma’s 217 per cent and Dacca Dying’s 213 per cent.

On the other hand, ML Dyeing witnessed the highest 52 per cent price fall in the just concluded year, followed by SK Trims’ 52 per cent, Standard Ceramics’ 49 per cent, KPPL’s 47 per cent, BD Thai’s 34 per cent, Paramount Textile’s 33 per cent, KPCL’s 32 per cent, Sonali Aansh Industries’ 31 per cent, Monno Agro’s 30 per cent and National Polymer Industries’ 30 per cent in the year.

Dhaka Bourses’ key index, DSEX, posted robust growth of 25.08 per cent to stand at 6,756 points on Thursday, the last session of 2021, thanks to effective regulatory measures that managed to regain investors’ confidence.

Interim growth rates place Bangladesh ahead of Pakistan, India, the United Kingdom, and Japan.

This year, the key index was at its all-time high, at 7,368 points. On the first trading day of this year, the DSEX stood at 5,618 points.

Liquidity driven stock market rallied in the year supported by expansionary policy, decrease of National Savings Certificate sales, lower interest rate on bank deposits, and the absence of investment alternative options during lockdowns prompted the investors to channel funds in stock market.

Analysts and market insiders said that investors regained confidence after the Bangladesh Securities and Exchange Commission (BSEC) took some punitive and reformative actions to bring discipline to the market.

They also said that investors’ buying rush continued as they expected better returns from the bullish market against the low bank deposit rates.

Meanwhile, market capitalisation at the Dhaka bourse rose to Tk 5,42,196 crore, or 20.96 per cent, this year. At the end of the year, its market cap to GDP ratio stood at 18.01 per cent.

Between June 9 and June 25 last year, turnover at the DSE remained below Tk 100 crore for 13 consecutive sessions, tumbling to a fresh 13-year low of Tk 38.6 crore on June 21, 2020. At the end of this year, the average turnover increased to Tk 1,476 crore on the Dhaka bourse.

Richard D’ Rozario, president of DSE Brokers Association of Bangladesh (DBA) told The Business Post that the Bangladeshi capital market, which was so much undervalued once upon a time, has turned around in the just finished year and performed well in the global context despite the Covid-19 woes.

During the pandemic, people had nothing to do with their idle money. Moreover, they received free money or low-interest money from the government, either in the name of a stimulus fund or as help for recovery. They found the capital market lucrative to invest their money, he added.

The gain in the index reflects investors’ optimism about the post-Covid turnaround of the economy.