Bangladesh had witnessed inflation hitting over a decade high in July during the deadly protests. The Boishommo Birodhi Chhatra Andolon movement ultimately triggered the Hasina regime’s downfall, making way for the interim government to take charge on August 8.

Several syndicates – who had the local consumer market in their grip for years – seem to have gone into hiding after the regime change, resulting in greater confidence in the overall economy, and a fall in living costs.

This is evident by the fact that essential commodity prices in kitchen markets across the country barely saw an increase in August, despite several regions in Bangladesh suffering from one of the worst floods in recent history.

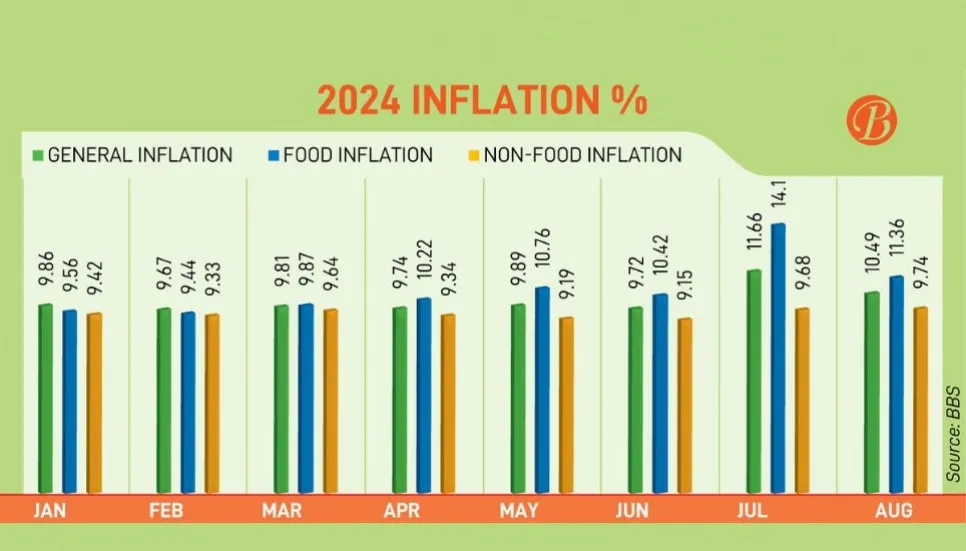

The latest inflation data prepared by the Bangladesh Bureau of Statistics (BBS) reflects this analysis. The overall point to point inflation has dropped to 10.49 per cent in August, from 11.66 per cent in July this year. Inflation had stood at 9.92 per cent in August last year.

Food inflation dipped in August as well, hitting 11.36 per cent in August, from 14.10 per cent in July. The non-food inflation was however increased slightly to 9.74 per cent in August, which was 9.68 per cent in July this year.

Speaking with The Business Post, Bangladesh Institute of International and Strategic Studies (BIISS) Research Director Dr Mahfuz Kabir said, “I think the key reason behind the drop in inflation in August is the significant drop in transport sector exportation.

“On the other hand, as a result of the political change, the syndicates that used to manipulate the wholesale markets in big cities are no longer active.”

He added, “It will take time to form a new syndicate. Besides, the Directorate of National Consumer Rights Protection is more active than ever before. In some cases, students are also working to prevent syndicate activities. These have had a positive impact on stabilising product prices.”

This researcher however believes that inflation could have dropped even more. “There was a huge loss of agricultural products due to sudden floods last month. If not for this loss, inflation might have gone into single digits in August,” he pointed out.

He added that the price of products in the international market is decreasing, while the price of fuel oil has gone down in the domestic market to some extent. “As a result of this, I think the inflation in September will be lower compared to August,” Dr Kabir said optimistically.

Despite the decrease in inflation in August, Bangladesh still has the highest inflation among South Asian countries, including Pakistan.

Pakistan brought down inflation to 9.6 per cent in August. India and Sri Lanka are yet to publish August data. In July, India saw 3.4 per cent and Sri Lanka saw 2.5 per cent overall inflation.

On the issue, Dr Kabir said, “The central banks of those countries have been able to keep inflation in check with a firm hand, maintaining order in the banking sector. But the role of Bangladesh Bank was not like that.

“As a result, there was chaos in the banks, and a lot of money was laundered. Due to this, the price of the USD increased, which in turn caused the goods prices to skyrocket.”

When asked how Pakistan is doing better than Bangladesh, Dr Kabir said, “Pakistan is not import dependent like Bangladesh. On the other hand, due to the decrease in reserves, Pakistan’s imports also dropped.

“As a result, even though the USD rate in Pakistan remained higher than that of Bangladesh, it had no effect on that country’s product prices.”

The interim government has put the most emphasis on taming inflation after assuming responsibilities. Keeping this goal in mind, the new central bank Governor and eminent economist Ahsan H Mansur recently increased the policy rate to 9 per cent.

Mansur has already given the indication to further hike this rate to 10 per cent, and continue to hike it until inflation reined in to a tolerable level.

Economists believe that raising the policy rate will increase interest rates on bank loans, discouraging people seeking to borrow from banks. As a result, the money flow in the market will decrease, and inflation will be in check.

As part of the interim government’s much needed reform measures, the Bangladesh Bank is restructuring the boards of troubled banks marred by irregularities and corruption, from which thousands of crores of Taka have been taken out in the name of loans.

Economists expect that such measures will gradually help check inflation in the coming years.

Inflation is high in rural areas

The BBS data – when making a comparison – shows that rural inflation is higher compared to urban area figures. The point-to-point general rural inflation was 10.95 per cent in August, while the urban inflation was 10.01 per cent in the same month.

Meanwhile, food inflation is higher in villages compared to the cities, although agricultural products are produced in the rural areas. While food inflation was 11.24 per cent in urban areas in August, compared to 11.44 per cent in rural areas recorded in the same month.

On the other hand, the demand for non-food items is lower in rural areas, compared to the urban areas. But the rate of such inflation is higher in rural areas than the urban.

Meanwhile, non-food inflation was 9.20 per cent in urban areas in August, compared to 10.45 per cent in rural areas.

Wages are not adjusting

Wages are not increasing at the same rate as inflation. While overall inflation was 10.49 per cent in August this year, wage growth was only 7.96 per cent. It means the real income during the month is negative 2.53 per cent.

Meanwhile, among the three sectors, the highest wage increase was in the agricultural sector at 8.25 per cent, followed by 8.24 per cent in services and 7.54 per cent in industry.

Although the agricultural sector’s contribution to Bangladesh’s GDP has decreased, 40 per cent of the country’s total labour force is employed in this sector.